Crypto

Simplifying Bitcoin Addresses Using DNS

Published

2 years agoon

This is an opinion editorial by Mark Jeftovic, cofounder and CEO of easyDNS Technologies Inc. and author of “Managing Mission Critical Domains and DNS.”

From the moment I discovered Bitcoin back in 2013, I knew there would eventually have to be a way to reference wallet addresses using human-readable labels.

The big problem with Bitcoin’s long addresses is that they are not memorable, and despite the pseudonymous or anonymous features of Bitcoin, a lot of the time you want to be able to easily assert or verify that a wallet address belongs to a specific entity — think donations to a charity or a crowdfund. This affects every blockchain.

As a DNS (domain name system) guy, I’ve seen this movie before: DNS was invented to solve the same problem with IPv4 addressing. Over time DNS evolved to do much more — not only did DNS add the capability to resolve IPv6 addresses, but it is also increasingly used to convey metadata about a namespace. Think SRV records, NAPTR’s, RBL blocklists, response policy zones (RPZs) and the ubiquitous TXT record (which is used for SPF, DMARC, DKIM and anything else that doesn’t natively fit the protocol).

Along comes Bitcoin and we have the same problem, writ large.

The Problem Specific To Bitcoin And Lightning

It’s looking like much of the payment transaction activity will move to Layer 2 with protocols like Lightning, and most recently the advent of the Lightning Address.

Lightning Addresses rely on the LNURL-pay protocol, and they look pretty much like an email address:

The email address nomenclature is the perfect way to convey identity information. It easily demarcates organizations and further subdivides to units or people within it. Everybody is already used to this format and as we’ll see, has the potential to convey much more information than destination mailboxes.

For years I was anticipating this format becoming the de facto standard for identity endpoints with Session Initiation Protocol (SIP) and XMPP.

SIP and XMPP didn’t take over the world quite the way I expected them to (at least not yet) and for a while, identifiers started gravitating toward centralized platforms like Twitter handles and Github user IDs. I always found this quizzical, especially among Bitcoiners.

With Lightning Addresses we see a path back toward decentralized identifiers, since email addresses are themselves decentralized, within the limits of the DNS system itself (more on that below).

There’s only one problem: the LNURL spec as defined is missing a level of abstraction. Without it, the use case for Lighting Addresses becomes very constrained.

Given the Lightning Address:

That means under the current specification, the payment descriptor will be located at:

https://example.com/.well-known/lnurlp/satoshi/

But what if Satoshi doesn’t have access to the example.com webserver? If we stick with the email address analogy: just because you have this as your address doesn’t mean the server with the matching hostname is where the email gets delivered.

In fact that’s probably not the case more often than it is. For this reason there exists the MX record type in DNS, which adds an extra level of indirection to control the destination for email. They may direct email delivery to hostnames operating under a completely different domain name (think about people who use an external email provider, but with their own custom domain).

The same thing needs to happen with Lightning Addresses for largely the same reasons. The hostname to the right of the ‘@’ may not have a webserver at all, or the user is unduly confined to using a Lightning Address where the hostname component can only be that of the webserver where the JSON file is hosted. That can be a problem when publishing a Lightning Address that the user wants to change down the road.

As a DNS guy, the solution seemed obvious but I was guilty of overthinking it:

In 2017 I was invited by what was then the Ethereum Name Service Working Group to a meeting in London to work out the specification for the ENS registry.

I left that meeting thinking that there needs to be a new DNS resource record, a new record type that would be able to reference blockchain resources from within the legacy DNS.

In my mind it would look something like a SRV or NAPTR record, which had different fields for protocols, ports and weightings (the fact that web browsers today still don’t look at SRV records for web addresses is one of the great missed opportunities of the internet age).

My working shorthand for it was “BCPTR” for “Blockchain Pointer” and it had an overcomplicated, convoluted specification for pointing out exactly which blockchain a record was pointing at and what type of resource it was.

Then in the Lightning GitHub issue, where the LNURL RFC was being discussed, somebody suggested simply prepending an address with the “_lud16” subdomain.

Using underscores to differentiate certain naming attributes from actual hostnames has been around for awhile. It was used in the original SRV RR spec RFC2872 and later described as “underscore scoping” in RFC 8552.

The suggestion immediately exploded in my brain and I realized that I had been overthinking this for years.

A scoped label in DNS, like _tcp or _udp, are case insensitive and we see them in SRV and NAPTR records for use in SIP, VOIP and ENUM applications, load balancing, not to mention in TXT records for DKIM and DomainKeys.

Pretty well any valid DNS label, like _lud16 or _btc, provides us with a mechanism to confine a response to a query matching the scope, under the parent node in the DNS tree.

Meaning:

$ORIGIN example.com.

_ie.test IN TXT “this is a test”_eg.test IN TXT “this is a separate test”

A DNS query for type TXT on “test.example.com” will not return an answer (NXDOMAIN).

A DNS query for type TXT on “_ie.test.example.com” will only return a result for the first record.

A DNS query for type TXT on “test._ie.example.com” will only return the second record.

In other words, we have multiple TXT records for the test.example.com leaf, however, we will only return the one queried with the scoped label, the one that begins with an underscore.

It turns out this is quite powerful for our purposes. It is also the easiest, optimal solution in our use case because:

- Everybody can use it.

- It’s a format people easily recognize.

- It can be retrofitted onto any existing email address via DNS.

- It provides the ability for a json record to exist someplace other than the server (like how an MX record functions).

- Can provide any kind of payload.

- Can work across all blockchains.

How Underscore Scoping Could Be Used In Blockchains

By taking the email address format used in Lightning Addresses: , we can use the convention via the DNS to specify all kinds of endpoints for the same identity:

$ORIGIN bombthrower.com.

_lud16.markjr IN TXT “https://my.ln-node/.well-known/lnurlp/markjr”

_btc.markjr IN TXT “bc1qu059yx6ygg9e6tgedktlsndm56jrckyf3waszl”

_ens.markjr IN TXT “0xEbE7CcC5A0D656AD3A153AFA3d543160B2E9EdFb”

We can get there from here without breaking anything already in place:

- Applications already using LNURL address can always keep using that

- Applications can add the DNS lookup

But DNS Is Centralized!

It’s true that DNS has an inverted tree structure that terminates at the root “.”. But even that root is fairly decentralized, comprising thousands of servers operated by at least 13 disparate operators. The legacy DNS may be logically centralized but in reality functions more like a decentralized federation of sorts.

Even this is changing, evolving. I think where we eventually end up is where namespaces straddle both the existing inverted tree root and fully decentralized blockchains.

Some of this is already here today: you could use something like Stacks and .btc domains which pins to Bitcoin and there will probably be other namespaces built directly atop Bitcoin.

Not all decentralized namespaces have legacy DNS resolvers, but that will change too. There is also work being done on a new DNSresolvers implementation which will resolve Stacks, .btc, and HNS domains by Handshake, and Unstoppable top-level domains. You can test it via lookups to alpha.dnsresolvers.com:

% dig +short easydns.btc @alpha.dnsresolvers.com

3.14.49.122

(This server is proof-of-concept and will go away in the future, please don’t add it to your resolv.conf.)

All This, And It Solves The Fake Twitter Handle Problem Too!

Once we make it a convention to use underscore scoping, we find we can solve all manner of problems using existing methods.

Let’s look at the fake Twitter handle problem that plagues the Bitcoin space.

The data structure of a Twitter user looks like this:

With underscore scoping we can assert the true Twitter handle from the hostname in the url element using the following convention:

$ORIGIN bombthrower.com.

stuntpope._twitter IN TXT “StuntPope”

*._twitter IN TXT “fake”

On its own, this doesn’t do anything. Nobody is going to open up a terminal window and type:

“dig -t TXT +short stuntpope._twitter.bombthrower.com”

… to find out if the person DMing you, “How is your trading going today?” is really me, or one of the legions of StuntPope imposters out there on Twitter. (I’m kidding of course, nobody in their right mind would impersonate me. But for a lot of the fintwit luminaries, this is a real problem.)

But what can happen if this becomes the convention, is developers can build quick and dirty hooks into their apps to do these lookups.

When a fake Twitter profile impersonates someone, they typically copy all the data verbatim, including the hostname in the URL field of the Twitter profile. If the real user has the records outlined above, then the convention of looking up the fake Twitter handle at the real URL will miss the actual _twitter TXT record for the real profile, and hit the wildcard record, causing a mismatch.

We’ve released a proof-of-concept Chrome extension through the easyDNS Github, which does just that with three modes:

A) No information asserted;

B) The profile matches the information asserted;

C) The profile does not match the information asserted (it’s a fake).

All this and more, can be done using very simple conventions in a ubiquitous protocol that’s already deployed.

Conclusion

Wallet addresses lend themselves to needing some kind of naming mechanism. There are multiple use cases where the need to securely assert an address from an identity takes precedence over pseudonymity or anonymity.

Further, to use human-readable labels or identifiers, we need an abstraction layer that provides flexibility and a format that is easily recognizable.

Finally, we can achieve all this using the DNS, which already underpins the technical infrastructure of the internet, is already a decentralized federation and on its way to anchoring on decentralized Layer 1 protocols. We can do so without adding any new record types or making any protocol additions to the existing specifications.

This is a guest post by Mark Jeftovic. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Crypto

El Salvador Takes First Step To Issue Bitcoin Volcano Bonds

Published

2 years agoon

November 22, 2022

El Salvador’s Minister of the Economy Maria Luisa Hayem Brevé submitted a digital assets issuance bill to the country’s legislative assembly, paving the way for the launch of its bitcoin-backed “volcano” bonds.

First announced one year ago today, the pioneering initiative seeks to attract capital and investors to El Salvador. It was revealed at the time the plans to issue $1 billion in bonds on the Liquid Network, a federated Bitcoin sidechain, with the proceedings of the bonds being split between a $500 million direct allocation to bitcoin and an investment of the same amount in building out energy and bitcoin mining infrastructure in the region.

A sidechain is an independent blockchain that runs parallel to another blockchain, allowing for tokens from that blockchain to be used securely in the sidechain while abiding by a different set of rules, performance requirements, and security mechanisms. Liquid is a sidechain of Bitcoin that allows bitcoin to flow between the Liquid and Bitcoin networks with a two-way peg. A representation of bitcoin used in the Liquid network is referred to as L-BTC. Its verifiably equivalent amount of BTC is managed and secured by the network’s members, called functionaries.

“Digital securities law will enable El Salvador to be the financial center of central and south America,” wrote Paolo Ardoino, CTO of cryptocurrency exchange Bitfinex, on Twitter.

Bitfinex is set to be granted a license in order to be able to process and list the bond issuance in El Salvador.

The bonds will pay a 6.5% yield and enable fast-tracked citizenship for investors. The government will share half the additional gains with investors as a Bitcoin Dividend once the original $500 million has been monetized. These dividends will be dispersed annually using Blockstream’s asset management platform.

The act of submitting the bill, which was hinted at earlier this year, kickstarts the first major milestone before the bonds can see the light of day. The next is getting it approved, which is expected to happen before Christmas, a source close to President Nayib Bukele told Bitcoin Magazine. The bill was submitted on November 17 and presented to the country’s Congress today. It is embedded in full below.

Crypto

How I’ll Talk To Family Members About Bitcoin This Thanksgiving

Published

2 years agoon

November 22, 2022

This is an opinion editorial by Joakim Book, a Research Fellow at the American Institute for Economic Research, contributor and copy editor for Bitcoin Magazine and a writer on all things money and financial history.

I don’t.

That’s it. That’s the article.

In all sincerity, that is the full message: Just don’t do it. It’s not worth it.

You’re not an excited teenager anymore, in desperate need of bragging credits or trying out your newfound wisdom. You’re not a preaching priestess with lost souls to save right before some imminent arrival of the day of reckoning. We have time.

Instead: just leave people alone. Seriously. They came to Thanksgiving dinner to relax and rejoice with family, laugh, tell stories and zone out for a day — not to be ambushed with what to them will sound like a deranged rant in some obscure topic they couldn’t care less about. Even if it’s the monetary system, which nobody understands anyway.

Get real.

If you’re not convinced of this Dale Carnegie-esque social approach, and you still naively think that your meager words in between bites can change anybody’s view on anything, here are some more serious reasons for why you don’t talk to friends and family about Bitcoin the protocol — but most certainly not bitcoin, the asset:

- Your family and friends don’t want to hear it. Move on.

- For op-sec reasons, you don’t want to draw unnecessary attention to the fact that you probably have a decent bitcoin stack. Hopefully, family and close friends should be safe enough to confide in, but people talk and that gossip can only hurt you.

- People find bitcoin interesting only when they’re ready to; everyone gets the price they deserve. Like Gigi says in “21 Lessons:”

“Bitcoin will be understood by you as soon as you are ready, and I also believe that the first fractions of a bitcoin will find you as soon as you are ready to receive them. In essence, everyone will get ₿itcoin at exactly the right time.”

It’s highly unlikely that your uncle or mother-in-law just happens to be at that stage, just when you’re about to sit down for dinner.

- Unless you can claim youth, old age or extreme poverty, there are very few people who genuinely haven’t heard of bitcoin. That means your evangelizing wouldn’t be preaching to lost, ignorant souls ready to be saved but the tired, huddled and jaded masses who could care less about the discovery that will change their societies more than the internal combustion engine, internet and Big Government combined. Big deal.

- What is the case, however, is that everyone in your prospective audience has already had a couple of touchpoints and rejected bitcoin for this or that standard FUD. It’s a scam; seems weird; it’s dead; let’s trust the central bankers, who have our best interest at heart.

No amount of FUD busting changes that impression, because nobody holds uninformed and fringe convictions for rational reasons, reasons that can be flipped by your enthusiastic arguments in-between wiping off cranberry sauce and grabbing another turkey slice. - It really is bad form to talk about money — and bitcoin is the best money there is. Be classy.

Now, I’m not saying to never ever talk about Bitcoin. We love to talk Bitcoin — that’s why we go to meetups, join Twitter Spaces, write, code, run nodes, listen to podcasts, attend conferences. People there get something about this monetary rebellion and have opted in to be part of it. Your unsuspecting family members have not; ambushing them with the wonders of multisig, the magically fast Lightning transactions or how they too really need to get on this hype train, like, yesterday, is unlikely to go down well.

However, if in the post-dinner lull on the porch someone comes to you one-on-one, whisky in hand and of an inquisitive mind, that’s a very different story. That’s personal rather than public, and it’s without the time constraints that so usually trouble us. It involves clarifying questions or doubts for somebody who is both expressively curious about the topic and available for the talk. That’s rare — cherish it, and nurture it.

Last year I wrote something about the proper role of political conversations in social settings. Since November was also election month, it’s appropriate to cite here:

“Politics, I’m starting to believe, best belongs in the closet — rebranded and brought out for the specific occasion. Or perhaps the bedroom, with those you most trust, love, and respect. Not in public, not with strangers, not with friends, and most certainly not with other people in your community. Purge it from your being as much as you possibly could, and refuse to let political issues invade the areas of our lives that we cherish; politics and political disagreements don’t belong there, and our lives are too important to let them be ruled by (mostly contrived) political disagreements.”

If anything, those words seem more true today than they even did then. And I posit to you that the same applies for bitcoin.

Everyone has some sort of impression or opinion of bitcoin — and most of them are plain wrong. But there’s nothing people love more than a savior in white armor, riding in to dispel their errors about some thing they are freshly out of fucks for. Just like politics, nobody really cares.

Leave them alone. They will find bitcoin in their own time, just like all of us did.

This is a guest post by Joakim Book. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This is an opinion editorial by Federico Tenga, a long time contributor to Bitcoin projects with experience as start-up founder, consultant and educator.

The term “smart contracts” predates the invention of the blockchain and Bitcoin itself. Its first mention is in a 1994 article by Nick Szabo, who defined smart contracts as a “computerized transaction protocol that executes the terms of a contract.” While by this definition Bitcoin, thanks to its scripting language, supported smart contracts from the very first block, the term was popularized only later by Ethereum promoters, who twisted the original definition as “code that is redundantly executed by all nodes in a global consensus network”

While delegating code execution to a global consensus network has advantages (e.g. it is easy to deploy unowed contracts, such as the popularly automated market makers), this design has one major flaw: lack of scalability (and privacy). If every node in a network must redundantly run the same code, the amount of code that can actually be executed without excessively increasing the cost of running a node (and thus preserving decentralization) remains scarce, meaning that only a small number of contracts can be executed.

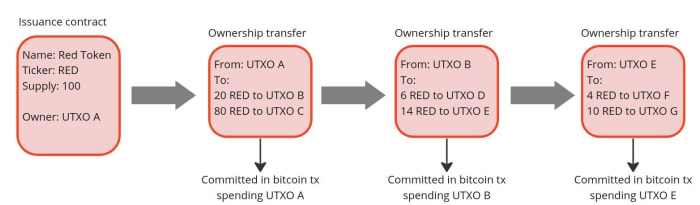

But what if we could design a system where the terms of the contract are executed and validated only by the parties involved, rather than by all members of the network? Let us imagine the example of a company that wants to issue shares. Instead of publishing the issuance contract publicly on a global ledger and using that ledger to track all future transfers of ownership, it could simply issue the shares privately and pass to the buyers the right to further transfer them. Then, the right to transfer ownership can be passed on to each new owner as if it were an amendment to the original issuance contract. In this way, each owner can independently verify that the shares he or she received are genuine by reading the original contract and validating that all the history of amendments that moved the shares conform to the rules set forth in the original contract.

This is actually nothing new, it is indeed the same mechanism that was used to transfer property before public registers became popular. In the U.K., for example, it was not compulsory to register a property when its ownership was transferred until the ‘90s. This means that still today over 15% of land in England and Wales is unregistered. If you are buying an unregistered property, instead of checking on a registry if the seller is the true owner, you would have to verify an unbroken chain of ownership going back at least 15 years (a period considered long enough to assume that the seller has sufficient title to the property). In doing so, you must ensure that any transfer of ownership has been carried out correctly and that any mortgages used for previous transactions have been paid off in full. This model has the advantage of improved privacy over ownership, and you do not have to rely on the maintainer of the public land register. On the other hand, it makes the verification of the seller’s ownership much more complicated for the buyer.

Source: Title deed of unregistered real estate propriety

How can the transfer of unregistered properties be improved? First of all, by making it a digitized process. If there is code that can be run by a computer to verify that all the history of ownership transfers is in compliance with the original contract rules, buying and selling becomes much faster and cheaper.

Secondly, to avoid the risk of the seller double-spending their asset, a system of proof of publication must be implemented. For example, we could implement a rule that every transfer of ownership must be committed on a predefined spot of a well-known newspaper (e.g. put the hash of the transfer of ownership in the upper-right corner of the first page of the New York Times). Since you cannot place the hash of a transfer in the same place twice, this prevents double-spending attempts. However, using a famous newspaper for this purpose has some disadvantages:

- You have to buy a lot of newspapers for the verification process. Not very practical.

- Each contract needs its own space in the newspaper. Not very scalable.

- The newspaper editor can easily censor or, even worse, simulate double-spending by putting a random hash in your slot, making any potential buyer of your asset think it has been sold before, and discouraging them from buying it. Not very trustless.

For these reasons, a better place to post proof of ownership transfers needs to be found. And what better option than the Bitcoin blockchain, an already established trusted public ledger with strong incentives to keep it censorship-resistant and decentralized?

If we use Bitcoin, we should not specify a fixed place in the block where the commitment to transfer ownership must occur (e.g. in the first transaction) because, just like with the editor of the New York Times, the miner could mess with it. A better approach is to place the commitment in a predefined Bitcoin transaction, more specifically in a transaction that originates from an unspent transaction output (UTXO) to which the ownership of the asset to be issued is linked. The link between an asset and a bitcoin UTXO can occur either in the contract that issues the asset or in a subsequent transfer of ownership, each time making the target UTXO the controller of the transferred asset. In this way, we have clearly defined where the obligation to transfer ownership should be (i.e in the Bitcoin transaction originating from a particular UTXO). Anyone running a Bitcoin node can independently verify the commitments and neither the miners nor any other entity are able to censor or interfere with the asset transfer in any way.

Since on the Bitcoin blockchain we only publish a commitment of an ownership transfer, not the content of the transfer itself, the seller needs a dedicated communication channel to provide the buyer with all the proofs that the ownership transfer is valid. This could be done in a number of ways, potentially even by printing out the proofs and shipping them with a carrier pigeon, which, while a bit impractical, would still do the job. But the best option to avoid the censorship and privacy violations is establish a direct peer-to-peer encrypted communication, which compared to the pigeons also has the advantage of being easy to integrate with a software to verify the proofs received from the counterparty.

This model just described for client-side validated contracts and ownership transfers is exactly what has been implemented with the RGB protocol. With RGB, it is possible to create a contract that defines rights, assigns them to one or more existing bitcoin UTXO and specifies how their ownership can be transferred. The contract can be created starting from a template, called a “schema,” in which the creator of the contract only adjusts the parameters and ownership rights, as is done with traditional legal contracts. Currently, there are two types of schemas in RGB: one for issuing fungible tokens (RGB20) and a second for issuing collectibles (RGB21), but in the future, more schemas can be developed by anyone in a permissionless fashion without requiring changes at the protocol level.

To use a more practical example, an issuer of fungible assets (e.g. company shares, stablecoins, etc.) can use the RGB20 schema template and create a contract defining how many tokens it will issue, the name of the asset and some additional metadata associated with it. It can then define which bitcoin UTXO has the right to transfer ownership of the created tokens and assign other rights to other UTXOs, such as the right to make a secondary issuance or to renominate the asset. Each client receiving tokens created by this contract will be able to verify the content of the Genesis contract and validate that any transfer of ownership in the history of the token received has complied with the rules set out therein.

So what can we do with RGB in practice today? First and foremost, it enables the issuance and the transfer of tokenized assets with better scalability and privacy compared to any existing alternative. On the privacy side, RGB benefits from the fact that all transfer-related data is kept client-side, so a blockchain observer cannot extract any information about the user’s financial activities (it is not even possible to distinguish a bitcoin transaction containing an RGB commitment from a regular one), moreover, the receiver shares with the sender only blinded UTXO (i. e. the hash of the concatenation between the UTXO in which she wish to receive the assets and a random number) instead of the UTXO itself, so it is not possible for the payer to monitor future activities of the receiver. To further increase the privacy of users, RGB also adopts the bulletproof cryptographic mechanism to hide the amounts in the history of asset transfers, so that even future owners of assets have an obfuscated view of the financial behavior of previous holders.

In terms of scalability, RGB offers some advantages as well. First of all, most of the data is kept off-chain, as the blockchain is only used as a commitment layer, reducing the fees that need to be paid and meaning that each client only validates the transfers it is interested in instead of all the activity of a global network. Since an RGB transfer still requires a Bitcoin transaction, the fee saving may seem minimal, but when you start introducing transaction batching they can quickly become massive. Indeed, it is possible to transfer all the tokens (or, more generally, “rights”) associated with a UTXO towards an arbitrary amount of recipients with a single commitment in a single bitcoin transaction. Let’s assume you are a service provider making payouts to several users at once. With RGB, you can commit in a single Bitcoin transaction thousands of transfers to thousands of users requesting different types of assets, making the marginal cost of each single payout absolutely negligible.

Another fee-saving mechanism for issuers of low value assets is that in RGB the issuance of an asset does not require paying fees. This happens because the creation of an issuance contract does not need to be committed on the blockchain. A contract simply defines to which already existing UTXO the newly issued assets will be allocated to. So if you are an artist interested in creating collectible tokens, you can issue as many as you want for free and then only pay the bitcoin transaction fee when a buyer shows up and requests the token to be assigned to their UTXO.

Furthermore, because RGB is built on top of bitcoin transactions, it is also compatible with the Lightning Network. While it is not yet implemented at the time of writing, it will be possible to create asset-specific Lightning channels and route payments through them, similar to how it works with normal Lightning transactions.

Conclusion

RGB is a groundbreaking innovation that opens up to new use cases using a completely new paradigm, but which tools are available to use it? If you want to experiment with the core of the technology itself, you should directly try out the RGB node. If you want to build applications on top of RGB without having to deep dive into the complexity of the protocol, you can use the rgb-lib library, which provides a simple interface for developers. If you just want to try to issue and transfer assets, you can play with Iris Wallet for Android, whose code is also open source on GitHub. If you just want to learn more about RGB you can check out this list of resources.

This is a guest post by Federico Tenga. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.