Crypto

Unpacking The “Lummis-Gillibrand Responsible Financial Innovation Act”

Published

2 years agoon

This is an opinion editorial by Beautyon, the CEO of Azteco.

In this post, I parse the above-named act, pointing out the glaring flaws and errors in it. It should be clear to any American that this bill is an abomination and that it should not pass into law. If it does, it will be challenged in the Supreme Court, struck down, removed with prejudice and the scathing chastisement it deserves.

The idea that there can be “responsible innovation” is absurd on its face. If Senators Cynthia Lummis and Kirsten Gillibrand were alive during the era of lake ice delivery by horse and cart, they would have found that the electric ice box was “irresponsible innovation” because many men would be put out of work and horses turned into glue or meat.

That is exactly what is happening with Bitcoin. This new innovation, which allows everyone to have the powers of a bank in their pocket or their business, puts pre-Bitcoin banks and their ignorant regulators out of business forever. This is “irresponsible” according to Lummis and Gillibrand, who want to preserve the broken and corrupt system and put a lick of orange paint on it to give it a modern look. This is the true meaning and effect of them tacking on and spraying the imaginary, concocted phrase “digital assets” throughout old regulations as is suggested in this bill. It’s blockchain fairy dust and it will not wash off.

Lummis and Gillibrand, with this scandalous, scabrously proposed bill, are going to cause American entrepreneurs (that have passports and know how to use a map) to opt out of their crony capitalist, anti-American sandbox for the free market — which is rapidly settling on bitcoin as the new global reserve currency in over 45 different countries. They can incorporate anywhere and their computers and staff don’t have to be in any particular place at all. No one has to or will choose to put up with this, unless they want to.

Here we go …

In the definitions section is the evil seed and root of the problem that started this absurd and deeply offensive nonsense. There is no such thing as a “Digital Asset.” That is an analogy used to contextualize bitcoin for computer illiterates, and not a real thing at all.

Many tools in software can be used to confer economic, proprietary (closed source) or access rights or powers. PGP/GPG (Pretty Good Privacy/GNU Privacy Guard) does this, and is not considered an asset, but under this definition, it can be classed as such — as can a plaintext username and password — because both of these things and many others confer access rights or powers. In the case of public-key encryption, access to plaintext and the power to decrypt.

Usernames and passwords are cryptographically secured when they are stored in databases, so they are captured by this definition also. This bad logic and computer illiteracy is what powered the insane non-fungible token (NFT) craze. It is obvious that the people who wrote this bill are totally ignorant when it comes to how computers and software works; otherwise they would have been more precise in their language to capture exactly what Bitcoin does, but of course if they did that, they could not have drafted this daft legislation at all. Lying is an absolute prerequisite here.

Similarly, the line, “any similar analogue” captures literally anything that can record data in an ordered manner, like an abacus or score in a video game. They probably thought they were being funny when they used the word “analogue” here. It’s not funny at all.

“Virtual currency” is a vague term that can mean literally any number on a screen where the viewer is led to believe he is looking at a balance that is allocated to him. That means any score in a video game, like “Super Mario Land 2: 6 Golden Coins,” where you literally collect coins.

Opening screen to Super Mario Land 2

Now, an unintelligent person would say that because that Game Boy game is not networked and the coins are not transferable, it is not “crypto” or “virtual currency,” but what they don’t understand is that the cartridge itself is the “digital wallet” which can be handed over for cash at any time, and the Game Boy device is the wallet viewer that anyone can use to confirm how many of the six golden coins are in the game.

If you don’t know anything about video games, have never played Super Mario Land, don’t know what cartridges are or how scores are kept in games, you should not be drafting legislation that touches bitcoin.

Stablecoins are of no interest and should not be conflated with bitcoin. That they are bundling all of these different tools and services into one piece of legislation further displays their total ignorance. Stablecoins are nothing more than contracts that don’t rely on mythical “blockchain technology,” but on the soundness of the companies issuing them and making the promises that their offering is backed, for which no new legislation is required.

If a company fraudulently claims that its proprietary database has one dollar per entry held in trust and that turns out not to be true, the directors have lied and committed fraud. No new law is required to cover that circumstance simply because they’re using a novel database and sales language to perpetrate the fraud.

“Other securities and commodities,” which ones?

Anyone writing video games could be forced to register because they’re keeping score in a game with a database and would be captured by this legislation. It is insane.

This definition makes it clear that the authors are computer illiterate, and that they do not understand how anything works in the 21st century. Every database on Earth that has replication, MySQL-NDB or other such capabilities is captured by this. What does “participate” mean here? How much of the database is “partial” enough to trigger this definition to return “true?” All databases in multiple nodes are synchronized by default. How can they not know this? How is it that they have no one on their staff who knows, or who knows which person or what question to ask?

Data is always appended to databases following consensus rules of the database engine. By this definition, Wikipedia falls under this because it has all the attributes of “distributed ledger technology.” Wikipedia,

- Is shared across a set of distributed nodes that participate in a network and store a complete or partial replica of the database.

- Is synchronized between the nodes.

- Has data appended to it by following the specified consensus mechanism of the Wikipedia moderators.

- May be accessible to anyone or restricted to a subset of participants.

- May require participants to have authorization to perform certain actions or require no authorization.

By the definition in this shabby, ridiculous and shameful bill, Wikipedia is a “distributed ledger technology” and is fully captured by the law, so it will be compelled to register with the Securities and Exchange Commission (SEC) or some other incompetent authority. If not, then why not? There is no “carve-out” that is possible here either, because the entire world’s biggest services (and small ones) all run on top of the principles Lummis and Gillibrand are trying to carve out for themselves and their anti-American cronies.

The term “digital asset intermediary” captures anyone who provides database services or collects information to be added to a database via a proprietary interface. “Digital asset activities” literally means rolling dice. Do you think I’m being absurd by saying this? I’m very serious.

Example one.

All of these would be considered “digital asset activities,” meaning that the manufacturers of the tools that facilitate the activities would fall under this legislation … and then what? Are they going to license the possession of dice? Sounds ridiculous, doesn’t it, but it is no more ridiculous than this absurd piece of draft legislation. It is ridiculous to claim that a mathematical operation done with dice is materially different to one done in a computer. By this logic, the First Amendment is constrained only to text written by hand, but not by a typewriter or on a computer.

The device you use to write with is immaterial, inconsequential and totally separate to your fundamental right to write and publish.

No American lawmaker should be unaware of this. Also, there is no exception in the First Amendment for writing that is math. Math is protected speech according to the First Amendment.

This ridiculous passage applies to Folding at Home, the distributed protein-folding project, BitTorrent and any tool where more than one computer is connected to another that splits the work or monitor system state. “Any similar analogue” means that Folding at Home is captured — heaven help them if they offer a financial reward to whoever finds the solution to a protein-folding problem because it could be seen as a “block reward” for finding the solution to a hard biology problem — which is exactly what bitcoin miners do!

When a Folding at Home participant finds a solution, that solution is sent to Folding at Home headquarters, where it has a monetary value to pharmaceutical companies. They are taking control of a unique “digital asset” that was mined and then transferred to them. All participants in Folding at Home and the discovery of solutions to the folding problem are captured by this law.

And now … Here it comes …

Oh dear.

There is no such thing as a “digital asset,” therefore the rest of this section falls. They’re building a tower of lies, layering lie upon lie upon lie. Why is a balance on a banking app not a “digital asset?” If you have the Chase Bank iPhone app, you can send money instantly to other Chase app users in the same way that you can send Lightning payments to anyone using a Lightning app. Chase uses distributed ledger technology underpinned by the COBOL programming language, so they’re 100% captured by this legislation. If not, why not?

The digital assets in a Chase app are not legal tender; it is “a digital representation of legal tender.” It is not backed by anything; Chase promises to pay legal tender to the sum shown in your Chase app; it is a form of contractual promise only, and not money. Chase certainly makes a statement in the form of a promise to pay U.S. dollars on demand to the account holder, and there is a hard peg of 1:1 for every digitally represented dollar in your Chase app. For all intents and purposes, and as defined in this draft legislation, the Chase banking app is a stablecoin app.

Does it immediately follow that Chase is now under these absurd and irrational “cryptocurrency” rules, or is there a carve-out exemption for the crony capitalists and vested interests set to be obliterated by the Bitcoin ecosystem?

“Used primarily as a medium of exchange.” This is, of course, totally absurd. The writers of software can have no knowledge of how a tool is used in the future, and burdening companies with rules borne of assumptions like this is irrational. What if the minority uses it to simply count anything, like how numbers are normally used? Should the fact that they are counting on a “blockchain” expose them to regulation? Why is counting money a regulatable act whereas counting a herd of ostriches is not? Or are ostriches not money? There are people who think that anything can be money, so in the confused minds of the people who think bitcoin is money, ostriches can be money too and should, quite naturally, be regulated.

Ostrich breeders are not really “breeders”; they’re ostrich miners. Ostrich sellers are not selling huge birds, they’re money transmitters. They are these things because I am a senator and I say so. This is exactly the type of logic that you’re seeing in this ill-advised bill.

This section specifies that it must not be legal tender. But bitcoin is legal tender in El Salvador, so therefore it is totally exempt from this bill, correct? If not, why not? If you’re going to say that the laws and definitions used in El Salvador have no force in the USA, then the opposite is also true and U.S. law cannot infect other countries. I think most non-U.S. citizens would be happy with that arrangement. Keep your odd, parochial ideas locked inside U.S. borders while we forge ahead into the future.

Bitcoin is a database administered by tens of thousands of people and incorporations all over the world. The Commodity Futures Trading Commission (CFTC) cannot be granted jurisdiction by fiat over foreigners and the software they’re running on their machines. This land grab, this power grab, will be rejected by all non-U.S. persons, sovereign nations and the foreign corporations wherever they are incorporated. The U.S. legislature cannot seize the intellectual property of foreigners or demand anything of any kind from them. This is hubris and ugly American chest-beating of the kind that has made America into a hated nation around the globe.

This section is interesting, because it shows how the State is scrambling to keep up with the myriad ways software developers come up with new market ideas. The very silly “digital collectible” or “NFT” fad is what is being obliquely referenced in line 26. By the time this bad legislation is rejected by both houses or is challenged by SCOTUS and purged, the NFT fad — like the ICO fad before it — will be dead and forgotten for some other shiny new distraction, and this language is totally irrelevant. “Hey Kidz. I see wut ur doin and ima legulize dat 4U.”

In this section, the legislators are carving out a legal requirement to use a licensed or chartered or registered entity subject to the rules they’ve already laid out for entities in the legacy system, in an attempt to open the door for those legacy entities to find a place in the new ecosystem, guaranteed by legislation. It is very unlikely and onerous if attempted, for any new incorporation to pass muster and act as a peer to deliver the service of holding “digital assets” (which don’t exist at all), and so the legacy incumbents are in a perfect position to continue to dominate with the blessings of the State.

Obviously, anyone in any jurisdiction other than the USA can ignore all of this and build a world-changing challenger company that can dominate globally. And they’re going to do it. This legislation can’t protect the legacy system from competition, as is its intention.

As for the line,

“(v) An appropriate foreign governmental authority in the home country of the custodian.”

U.S. law can’t determine what is and is not “appropriate” for foreigners to do, or the standards they should adhere to, if any. Who do these people think they are? Many awake Americans have the means and knowledge to use the great advantages that foreign jurisdictions bring to the market. They are not going to be dissuaded, corralled, coerced or shamed into capitulating to this anti-American drivel, should it even become law.

Also, the cancerous tentacles it inserts into other legislation over its 60-plus pages represents a maze of pure filth that will be very difficult to untangle should anyone try to salvage this unspeakable garbage. Even if they do, it is an absolute certainty that the interns tasked with doing it will be Ivy League computer illiterates with the worst human characteristics and tendencies, i.e., crony capitalism, hubris, superiority complex, sociopathy, socialism, etc., and will be diametrically opposed to Bitcoin and everything to do with it out of the gates.

Bitcoin is permissionless, and companies that work with it should not require advance permission to use that database for any purpose. Since it is a (soon to be acknowledged as) First Amendment Protected Activity (FAPA), this will be struck down as prior restraint. The U.S. government cannot stop a person from publishing anything in advance because they simply believe it may cause harm. This all goes back to what Bitcoin actually is and how it works.

People making Bitcoin transactions are publishing text to a public database that anyone can read, even machines. As you’ve seen above, all the operations required to use Bitcoin can be done manually. They are done by machines for convenience and speed, but the acts being done are without question acts protected by the First Amendment.

Whether or not some computer illiterate understands this is irrelevant. The SCOTUS will be made to understand it and they will strike this bill down with furious anger, should the majority of Congress be corrupt enough to vote it into law.

It is absurd that this section is inserted. They’re saying that it is unlawful unless the customer waives his protections (nota bene: “protection” not “right”) with the CFTC. It should not be a requirement that a consumer needs to do this. By dint of going into contract with the company they’re getting service from, they can waive their mafia “protection” upon signature. Why do these people believe that individuals should write letters that will never be read or relied upon to them? Who do they think they are that they believe they can put onerous and obnoxious burdens on anyone? Why are the contracts that people voluntarily engage in sufficient in other areas to waive all sorts of other “rights” but are insufficient in this particular matter, requiring that an additional supplementary letter must be sent? This is entirely illogical and an artificial burden on consumers that serves no purpose and protects no one.

If the acts they’re trying to prevent are really worth preventing, surely they should not allow them at all, and not allow people to put themselves at risk, if it really is the task of the CFTC to keep people safe from themselves. Why not, then, allow people to opt out of all CFTC rules entirely, by simply writing a letter proclaiming:

“I want none of your protections nor anything to do with you. I waive all protections afforded and offered by CFTC in perpetuity.”

Why not?

Once again, there is no such thing as a “digital asset.” Keeping this in mind, why is it that the Hollywood Stock Exchange (HSX), created by the genius Max Keiser, was not deemed to be under CFTC/SEC jurisdiction? No one has an answer for this. Those that have considered these matters who are determined to etch their names in the legislative rolls are not concerned. All they desire is to be famous, and to have their names immortalized in a bill.

HSX is called, “a game” but why is it a game? Why aren’t bitcoin exchanges considered “games?” They are indistinguishable from HSX. Is it the case that if any bitcoin exchange called itself a game that none of these crazy new rules would apply? No one can answer this, obviously, and this is the crux of the problem.

If the HSX decided to swap out its MySQL database and use Solana or Bitcoin, would the function of HSX suddenly change? Of course, it would not, but saying this exposes the entire thought process of this bill for the nonsense that it is, and this perfectly sound, irrefutable argument will be used in the SCOTUS case to destroy the possibility all new Bitcoin regulation in the USA, and force the removal of existing regulation.

People with limited intellectual resources will prattle off “blockchain speak” to describe why MySQL isn’t the same as Bitcoin, but they are only able to think in analogies that have been spoon-fed to them, and can’t deal with reality and facts. Even when you demonstrate how their thinking is totally wrong, they refuse to accept it because they’re members of what is effectively a brainwashing cult, with the added incentive of financial investment and greed up to the neck, to keep them fully enslaved and in thrall to the blockchain cult narratives, speech patterns and blathering.

In the drafting of this daft nonsense, the drafters subconsciously know that what they’re doing is 100% wrong. This is why in this section, it says:

“IN GENERAL. — Any trading facility that offers or seeks to offer a market in digital assets may register with the Commission as a digital asset exchange…”

They may register or they may not register. It doesn’t say they must register. Why not? Under what exact circumstances is a service to be exempted from registration? Obviously, the Hollywood Stock Exchange is not a “real” stock exchange because everything in it is made up, but so is everything on any “crypto exchange” where people have simply decided that they want to play that game and take the consequences. No, just because people pay for a game service doesn’t mean it is “financial activity” analogous to real stock exchanges, genius.

The reason why these misguided and dangerous people can’t say with absolute certainty which agency or rule applies to databases is that they have no understanding of how anything works or what anything really is. They are victims of their own lies, narratives and concoctions. This is why they’re equivocal, uncertain and leaving it up to the applicants, using gestures, rules of thumb, analogies and false definitions to circumscribe a fake territory for themselves to rule over.

If no one chooses to register with the CFTC because the context is a paid-for game in their terms of service, under what pretext is the CFTC authorized to act? There is no legal restriction on the use of financial terms in any game, so entrepreneurs are free to make 1:1 copies of any financial system service, exchange or trading desk. Like the Hollywood Stock Exchange, with all of its related terms, graphs, tools and ephemera, in a perfect simulation that is not real, they have the absolute right to charge for access to their game on whatever terms the players will accept. And no, putting an upper cap on how much people can charge for a service is not an option. And no, gambling laws would not capture these sites recontextualized as games because they don’t quote odds and will explicitly disclaim that gambling is the activity in which users are engaging.

This is the true nature of what is going on with fictitious “digital assets” and the entire field that the power-mad fame-seekers have been gulled into believing was real. Now requiring “rules of the road” concocted by them and their misguided band of anonymous crony capitalists, ignorant interns and anti-American suicide squad saboteurs.

By this section, Ethereum and all altcoins the drafters mistakenly considered to be “digital assets” cannot be traded on the basis of this new law. All altcoins in proof-of-stake systems or with super-node controllers or any system with a central company that can change rules, stop a system entirely or do anything unilaterally, cannot be used under this proposed law.

Manipulation is undefined here; who is to say moving from proof-of-work mining to proof-of-stake consensus is not manipulation? Proof-of-stake immediately puts those with stake above those with no stake, creating a multi-tiered and provably unfair system. It is also arguably a breach of promise, depending on the terms and conditions of the “blockchain” making the changes.

You all know that “Faketoshi” is trying to reverse ancient transactions to have money allocated to himself. Were he to succeed in doing this, bitcoin and all its derivatives would be captured by this crazy rule. And of course, super-node gatekeeper controllers fulfill the criteria of “…functionality or operation of the digital asset can be materially altered by any person or group of persons under common control.”

Since so many “coins” fall afoul of this, it is obvious that game sites that mimic commodity and stock exchanges using them should not and cannot fall under CFTC remit, but instead are just game points on a new database. They all escape these irrational rules if the rules become law. Otherwise, all game point systems fall under the rules and must be stopped.

The networks that mediate the databases used in what these ill-informed characters call “digital assets” all rely upon and are built on other people using the work put into managing the network to preserve network integrity and keep the network running and viable. To say that these businesses cannot use the tool they are using (use of which is required to keep the tool viable) is irrational and illogical. The most simple example of this is “mining fees” which must be paid to make transactions on the network, or in proof-of-stake, using the fact that stake is held that may be allocated to customers as part of the proof.

Once again, they are saying that any customer who agrees to be exempted from these rules may be exempted through a waiver … so then, why stipulate the rule in the first place? All the business has to do is make the waiver part of the terms and conditions and then the rule is instantly nullified by default.

What they’re saying here is that companies are to be compelled to publish proprietary market data that may advantage their foreign competitors. Efficient market mechanisms emerge from the market, not by command of the State, which is a first-class blundering, stumbling, incompetent meddler.

Similarly, you can’t compel people to enforce a nebulous idea of “rules” that are not explicitly codified. Also, “protect” doesn’t mean anything in this context either; protect who from what, exactly? And what does “abusive” mean? Making excessive profit, no doubt; many of the people behind this bill are socialists in all but name. “Fair” doesn’t mean anything either.

The rest of this section is full of twaddle. All betraying the absurd idea that these new exchange services are analogues of the existing stock and commodities markets, and that similar rules should be applied to these nascent markets, unchanged without any new assumptions, correct assumptions, new thinking or any thinking at all. The requirement to have a back door open to the CFTC however is galling and insulting, and enshrines privacy violation. Absolutely horrible and utterly anti-American.

Once again, only a maniacal despot would demand this intrusion, disruption, violation and invasion of private businesses by the CFTC (or any other agency), and the power to liquidate positions at the CFTC’s command or even suspend service at their orders. Of course, should this insulting drivel be passed into law, the spur will have been heeled into the side of the donkey to produce more exchanges like Bisq that the CFTC can’t touch.

Why? Why should anyone be compelled to divulge proprietary business information to the CFTC? If no breach of contract or lawsuit is underway, and no criminal act is accused and no warrants issued, why should evidence be forced out of anyone? That isn’t how America works. Before you can be compelled to divulge information a warrant must be issued. That’s the Fourth Amendment to the U.S. Constitution, geniuses. Did you know that? How can legislators not know this?

As for making trading volume public, that’s proprietary information. Price information is already published so that the market can work, genius. Why doesn’t the CFTC collect this information itself on its own equipment? Because they’re incompetent, that’s why. What is “other trading data?” If you don’t specify, anyone who is sane won’t provide anything not explicitly requested. That should be the default, should this vile and evil law be passed.

First of all, exchanges do not want to be over capacity, ever. Stipulating this is absurd and insulting. No one wants to ever have incomplete records due to overcapacity events. What is demanded here is a strictly technical requirement that the CFTC has no business asking for. The shareholders of every company working with Bitcoin demand fine-grained information and reporting, as do the users of the trading systems. If any company does not produce rich data, consumers will move to services that do. The market takes care of this. CFTC is not needed at all and their interference is un-American and unwelcome by real Americans.

Record keeping is a business operation that should only be done to the satisfaction and requirements of the business owners, shareholders and their clients, and not for the needs of the CFTC. If they want people to do the record-keeping work, they should ask politely and then pay for the records to be maintained, since they are being kept for the CFTC and no one else.

Compulsory reporting of information should be under warrant only and not from a blanket demand of “anything we want, any time.” Who do these people think they are? And the same goes for the SEC, tagged along here.

Of course, you would expect these agencies to abuse your information and spread it across all branches of the American government, including NSA, CIA and all the other secret agencies. It’s wrong and can be prevented. What is astonishing here is that they’re making it law that the CFTC will share the information of American corporations and citizens with foreign ministries. How can anyone calling themselves a “Republican” draft such an outrageous and sovereignty-violating statute? It’s breathtaking and shocking. Absolutely, purely anti-American.

There is only one conflict of interest on display here: the conflict of interest between the CFTC and American entrepreneurs and citizens with this abusive, anti-competitive, irrational, ridiculous, onerous nonsense.

How is any business going to have financial resources on hand to serve customers when they’re being blackmailed into spending money to satisfy the unquenchable thirst of the CFTC? Why does the wind-down clause not come with an opt-out for users who want to take the risk of dealing with a company that doesn’t make the promise to hold wind-down contingency funds? They allow an opt-out for other things. Why not this? Why not allow an opt-out for the whole shabby bill and its scandalous provisions?

All of these are business and software requirements full of words that the drafters clearly don’t understand. For example, what does “reliable” mean in terms of … anything? As for risk analysis, complex systems that interact in office and over APIs have multiplicative error scenarios and failure modes that can’t be predicted very easily. Trying to war-game these out in advance is an entirely unreasonable requirement, and in any case, the people who build these systems know what they’re doing in general and understand that they have to maintain uptime, a word these drafters are clearly not familiar with in this context.

Testing and other technical measures, techniques, procedures and the myriad tasks that system administrators do should not be a part of any law. All technical measures and specifications are private matters for companies, who can buy insurance against faults if they want. Similarly with backups: Backups are only one way of ensuring continuity. If users have their own private keys, no backup is required at the company level. This shows the drafters are in fact computer illiterate and don’t have the necessary imagination to draft legislation — were it legitimate in the first place — that covers all possible arrangements of software in a business.

The line about the audit trail is similarly absurd. They don’t like Bitcoin, but want a perfect audit trail — which Bitcoin provides out of the box. Bitcoin is the audit trail by design, but if they concede this, they have to acknowledge that bitcoin isn’t money, but an audit-trail database.

Tough times for the computer illiterate!

These people seem to understand that everything they’ve drafted could be horribly wrong and destructive to America’s dominance in this new field. This is why they’ve put in this trapdoor to exempt any company that is doing well from these ignorant and ill-advised rule proposals, which can be revoked retroactively, meaning that if a company becomes a trillion-dollar service serving people globally, they’re making a provision so that that company can be left unmolested because it is part of the critical infrastructure — like the banks they bailed out, who were exempted from the rules due to the threat of systemic risk.

They are carving up this new database industry and handing out the pieces to their cronies. They’re also saying here that they can add to these insane rules at any time; that’s what “prescribing rules” means — more poison pills.

As for the requirements not to register, all that is needed is to incorporate outside of the USA. It’s easy to do, and many companies working with these new databases do it. This avoidance behavior is a precursor to what’s coming: No one with a brain cell and a passport is going to put up with this if it becomes law, and other jurisdictions are licking their lips as they read this because they know it is going to push hundreds of billions of dollars into their jurisdictions.

This is a generic example of how they’re polluting other legislation in this bill. They are adding the fictitious term “digital asset” all over the place to capture any database that simulates money. Some intern went through other legislation and selected places where this invented term can be inserted. The legal and business side effects of these multiple insertions are unknowable in advance. Adding this language puts many industries and individuals at risk, and as Nancy Pelosi famously said, “We have to pass the bill so that you can find out what is in it.”

They’re trying to enshrine the conflation of physical assets like gold and entries on the Bitcoin database. There is no such thing as a “digital commodity.” That term is an analogy created to help computer illiterates understand how these new database arrangements can be used; it is not a description of what they actually are. Lummis and Gillibrand have missed this entirely and been tricked into thinking an analogy is reality.

They have to redefine what a financial institution is because database companies are not financial institutions. This section is a key indicator of the nature of this bill and the land grab that is being attempted.

So, having created this abominable anti-American farrago, they’re proposing to push the cost of administering the rules they have created onto the people running the services. This is absolutely despicable. If these corrupt, debased, debauched, degenerate, depraved, disgraceful, disreputable, perverted, profligate and shameless thugs obeyed their oaths, there would be no extra costs to business people who simply want to serve others, which is their absolute right. What a nerve these people have.

Oh, they’re so kind! Remember the appalling and destructive New York “BitLicense,” where applying for it is so expensive that Bitcoin companies simply choose not to do anything there, rather than pay? Here is a pro tip: Companies will leave America entirely rather than be exposed to the insane risk, exorbitant and unethical fees, the predation, prejudice, inconvenience, consumer violation by law and morally repugnant rules these monsters are threatening everyone with.

For way less than the cost of a BitLicense, a company can incorporate in Hong Kong and be totally free of this totalitarian nonsense. They can incorporate in El Salvador, where the government is embracing innovators … and the weather is good there too.

There is no reason any entrepreneur anywhere on Earth needs to put up with this. In the disastrous outcome that it should become law, it will mean that other countries will gain the businesses that are de facto prohibited in the USA and American citizens will use those services — without the permission of anyone, just as they do other things that are forbidden by the State in the USA, like “online gambling.”

Bitcoin, like pirated software, cannot be stopped. All of the incentives of pirated software exist in Bitcoin, except they are exponentially bigger in every way. The desire to get the latest software and movies is very strong; just imagine how strong the incentive will be to get bitcoin, since you need it to buy things online and exist? The company that solves “the bitcoin delivery problem” will be a multibillion dollar unicorn, and it doesn’t have to be based in the USA either. None of the drafters of this sad, tawdry bill understand these facts.

If they had any sense, ethics, understanding or fealty to the oath they swore, these members of Congress would do nothing and let the market sort everything out for itself. Then, once the new market is established, they can gently milk it. The problem is these people are old and dying, and they want to hurt as many young, vibrant people as they can because they’re jealous of Bitcoiners and the power being unleashed by Bitcoin. They’re like a dying, old coot, doing his best to put the knife in one last time by changing his will to cut out his disobedient children.

This scandalous bill gets stupider the deeper you go into it. How can a protocol ensure that the scope of permissible transactions that may be undertaken is disclosed in a customer agreement? A protocol is not a person, has no rights or obligations and can’t be compelled to do anything. How can people be so stupid?

This is totally absurd. Under “9802. Consumer protection standards for digital assets” if bitcoin is classified and captured as a “digital asset” then prior to any updates, the users of Bitcoin would need to be informed before material source code version changes. Each customer. Which is 100% insane. Of course, there is no Bitcoin company at all, which leads to the question, are developers on Bitcoin itself going to be attacked by the CFTC for doing “git push?”

Since Bitcoin is not a company or a person, clearly none of this should or even could apply to it. That means that either bitcoin is not a “digital asset” or they’re just going to ignore Bitcoin as a thing, and only go after tools where there is an identifiable company and people who they can persecute and torment.

If on the other hand, bitcoin is classed by them as a “digital asset,” how are they going to administer any of this? By misusing English and terminology, they’ve built an effigy that makes no sense at all and doesn’t take reality into account.

This section shows the problem. Are they actually claiming that a fork of Bitcoin is a “subsidiary proceed?” Anyone can fork any code repository and create their own chain; there are even tools online that allow you to create your own clone of Bitcoin, delivering you the software you need after filling out a simple form. Under this bill, that would be a regulated act, as would making a complete copy of Bitcoin and its transaction history (block chain).

Once again, these people are computer illiterates who don’t understand anything, and who are flailing about, trying to appear relevant. They’re actually super dangerous anti-Americans and I hope their bill is rejected in its entirety to avoid real Americans going to SCOTUS to have it destroyed.

The meddling continues. What the section on line 5 says is that matters of source code and not function will be agreed to in writing. It is extraordinarily rare that any consumer will have any knowledge of the source code used to perform a consumer function, and the mandatory exposure of proprietary and secret source code is a rights violation. The people who wrote this don’t understand anything about software or how it is developed.

If this section is justifiable and reasonable for altcoins, why hasn’t the Senate and Congress mandated similar rules for Microsoft Windows and Apple iOS? More money and lives depend on those operating systems than on “cryptocurrency.” What about all of the other software packages that the world relies upon, like OpenSSH, Apache and every other package that runs literally everything on Earth? These misguided people have no idea what they’re talking about and have conjured this nonsense out of a complete misunderstanding of what software is and the well-established, safe and accepted ways it is developed, deployed and updated.

Forbidding changes in source code or the way networks work by changing the source code, should this insanity on stilts become law, will immediately prevent the beleaguered Ethereum project from switching to proof-of-stake from proof-of-work.

Let’s imagine for a minute that you’re drunk on Tequila and you imagine that switching from proof-of-work to proof-of-stake will be a good thing for Ethereum; it would not be allowed under the Lummis-Gillibrand bill under these rules. This section means that once a system is released and people are relying on it, it will not be possible for it to pivot to something better or anything. This is Kingdom of Moltz-level anti-innovation. Users are never, ever consulted about source code. Anyone who has any experience in this knows that. The drafters of this are totally incompetent and ignorant.

Settlement finality, which is the wrong phrase for what happens when something happens in Bitcoin, is not a feature of tools where there is consensus governed by super nodes who can collaborate to undo transactions. The conditions under which things happen in a database are not the business of the CFTC, but are business logic to be determined solely by the software developers and the business owners demanding and designing features. This is like the Soviet Union making commands about economics and the mechanics of tire manufacturing.

Legal certainty is not required in Bitcoin transactions; that is why the code was written in the first place. Users have certainty in math, not legal enforcement. The fact that the authors say this shows they have no idea of why Bitcoin was written or what the certainty of math really is. The law is not required to guarantee anything in Bitcoin; it guarantees itself and protects its users from characters like Lummis and Gillibrand.

This is very interesting. The European Union is planning on outlawing “unhosted wallets” where messages can be initiated without the need for a third party. That means any of the ethical Bitcoin wallets — Samourai, Breez, Wallet of Satoshi, Muun, Pine, Phoenix — may be made illegal in the EU. This section is diametrically opposed to that idea, saying that no one should be compelled or required to use a “hosted wallet.” Clearly, wallet developers who maintain the tools in the above list and any wallet where users have full control over Bitcoin will have to address this, ending up in the USA and shunning all EU customers. In any case, you can expect the Apple App Store and Google Play to remove all “unhosted wallets” to comply with EU fascism and crony capitalism.

Somehow, some cheeky intern snuck this into the draft of this bill. You can be sure it will be removed once someone points out what it really means. It contradicts itself with section (1); having your own keys explicitly permits any person to engage in market activity for which authorization is required under federal or state law — without any authorization or permission. It means you can transact freely without permission, you cretins.

I’m skipping the part about “stablecoins.”

These people seem to understand that Bitcoin and other tools completely destroy their punitive and unethical collective-punishment “sanctions regime,” and not having found an answer in time for the drafting of this abomination, kick the can down the road to other people who will also not be able to solve this unsolvable problem.

Bitcoin is like the invention of math itself; it is a fundamentally new tool that once unleashed, will have effects that can’t be contained. It’s like unleashing the idea of the wheel and then expecting no one to make use of it, or trying to reduce the efficiency of the transport of goods moved on wheels by strictly licensing how carts on wheels can travel and who is allowed to use them.

If you think that’s insane and could never happen in reality, you are ignorant of the Locomotive Acts (or Red Flag Acts) that were introduced when motor cars were beginning to gain popularity. Oddly enough and unironically, Lummis is calling for “rules of the road” in Bitcoin. You couldn’t make it up if you tried.

The Comptroller of the Currency, being tasked with assessing “payment system risk,” is putting the fox in charge of the henhouse. When they say “payment system,” they mean the corrupt Federal Reserve system and all the cronies that feed off of that system and the public. Anything that poses a risk to that — Bitcoin and its ecosystem of companies — is an enemy, even when, as in the case of Bitcoin, the public and the United States itself will benefit by the emergence of a parallel system that is not under the comptroller’s power to control, supervise or develop rules for.

As for “community contribution plans,” by merely existing and serving people for a profit, Bitcoin companies are contributing to and protecting “the community” because they’re insulating them against the lethal inflation and theft in the legacy financial system. Consumer education happens automagically by people being shown that bitcoin is better, and doesn’t need to be compelled. As for “financial literacy,” that actually means propaganda and lying to keep the public gulled and believing that the fiat system is safe and fair, when it manifestly is not.

“I’m from the government, and I’m here to help.” What does “adequate” mean? Why do these people believe that they’re anointed to declare by royal decree that a market is “competitive enough,” and by what metric do they determine this? Who do these people think they are?

This enshrines in law and puts into the open the “snitch hubs” that have been operating in secret, started by unethical companies where law enforcement could come for guidance, make requests and do all sorts of other nefarious things in secret. Note how they appropriate the language of the free market to cover this unethical nonsense: They call it an “Innovation Laboratory” when it is in fact a “surveillance hub.” Regulatory dialogue is not “innovation,” nor does it foster, engender or promote it. Data sharing — a privacy violation — doesn’t help innovation either. As for “appropriate supervision of financial technology,” no one who swore an oath to uphold the Constitution should think that is appropriate in any way, and Bitcoin supervision is ultra vires.

These people like the language and culture of innovation. That’s why this appalling piece of garbage was put on GitHub, so that the shine of the new and hip can rub off on it, when in fact it is old, dried up, irrelevant, ugly and nasty. It’s like a 100-year-old woman putting on lipstick used by prostitutes, thinking it makes her look young. It doesn’t. It’s repulsive.

“Chief Innovation Officer” is the sort of post you’d expect to find in the Soviet Union, not in a free-market United States of America. Innovation is a matter for the market, not for the State. The government should not be in the business of picking winners. That this has to be said in 2022 is flabbergasting.

This absurd Laboratory (that is not a Laboratory at all) is tasked with surveilling new software innovations to ensure that they’re not a threat to the status quo. This is the real meaning of “supervision of financial technology”: databases. They don’t have the staff or the competence to be able to surveil the entire market and will rely on very ignorant and naive developers to report themselves to the Comptroller of Innovation with their new ideas before publishing them. This is, of course, anathema to any true software developer. Imagine if Satoshi Nakamoto went to the CFTC to ask them if he could release Bitcoin. Imagine if Elizabeth Stark asked permission before releasing Lightning. It’s unthinkable and impossible.

The extent to which this appalling law poisons the economy and people working in software — should it even pass, which is not a given — is entirely up to the people doing the actual work of running companies and writing software. If no one cooperates, it cannot possibly work. Uber didn’t apply for licenses to be a taxi company, and once they succeeded, they could buy off the Lummis class to keep them quiet. They did this all over the world. Everyone is the winner as a result. This absolutely must happen in Bitcoin if this sad legislation becomes law.

“Certain novel legal positions?” Bitcoin is not in a novel legal position; it is not illegal and it is a form of writing within the law. Bitcoin was not written to frustrate precedents, though it is outside the traditions of the Federal Reserve Act and “our” dual banking system. (Who is “our” exactly? The Fed is a private bank; it is not owned by the American people or their corrupt government.) The imperatives of Congress cannot be invoked here either, because the Constitution specifies what money is in the USA, not any particular modern session of Congress.

Bitcoin is an extraordinarily brilliant construction on several fronts simultaneously, the only responses to it are total acceptance or dismantling of America’s fundamental law — either explicitly or through unconstitutional legislation that will be challenged.

Bitcoin behaves like money, but it is not money; It is speech that behaves like money.

This is the property that makes Bitcoin so powerful and corrosive to the State. This absurd legislation is flailing around like a screaming housewife whose frying pan is on fire. They can’t construct any means to approach it and control it, and I think they know this.

Bitcoin is novel. It is as novel and disruptive as the Gutenberg printing press or the internal combustion engine or the refrigerator. There really isn’t anything anyone can do to stop it now. It is too useful in many ways, the most important of which ordinary people don’t care about: a switch to Austrian Economics from Keynesianism.

All of these technical specifications, which in any universe should never be introduced or drafted by anyone other than competent people in the actual industry, will go away in the world where bitcoin is the only money. Imagine Lummis making a demand for changes in the Bitcoin address format; if you think that’s absurd, you’d be right. If you think it can never happen, you’d be wrong, and this section proves it.

Who wrote this drivel? How is it that a technical specification has been inserted here? Who asked for it? Who does it serve? Why don’t people ask these questions, and why are not the hundreds of drafters of this garbage all in an index that names them, their affiliations and links to the legislation they’ve requested be inserted? Why the lack of transparency? What do they have to hide?

This means there will be an “examiner” (who will be a computer illiterate, you can be sure), who everyone is terrified of getting a phone call from. That’s if they decide to be polite and not just raid your offices with a SWAT team.

What this section does is say, “We will be making some other laws, open-ended in scope, that we will announce later.” That’s unacceptable. Bitcoin is not money, and anti-money laundering laws should not apply to it at all. Sanctions, as you should now understand, are rendered moot by Bitcoin, so making American companies jump through hoops for it just makes them uncompetitive on the international stage, the exact opposite of what any American wants.

And there’s that “payment system risk” talk that we talked about earlier. Consumers are protected in Bitcoin by default, if they use the correct tools. That means tools in the style of Pine, BlueWallet, Phoenix, Muun, Wallet of Satoshi, Samourai Wallet and Breez. In case you didn’t know, Pine is developed in the EU, BlueWallet in the U.K., Phoenix in France, Muun not in the USA (I believe), Wallet of Satoshi in Australia, and Breez comes from Israel. All of the best wallets already come from countries beyond U.S. jurisdiction. This should frighten any real American who wants America to dominate in Bitcoin. This crazy law won’t help America win.

Bitcoin is not a “financial asset” and therefore should not be touched, regulated, rule-made, distorted or bother the people who use it in any way by the SEC or the CFTC. It is a lie to claim that jurisdictional arbitrage opportunities produce uncertainty for innovators; innovators can read, have lawyers and can choose the jurisdictions that are best for their business models. Uniformity is poison to innovation and the coming multipolar world will make life better for innovative entrepreneurs and Bitcoiners alike.

Once again, the “systemic risk” they talk about is risk to them alone and their so-far unchallenged positions as the sole gatekeepers for everyone’s money and financial services. Bitcoin disrupts this status quo and that’s what they’re trying to kill. They will not succeed. Codifying rules in this case means bringing Bitcoin and Bitcoin companies inside the fence. They say this explicitly. They actually believe that they can bring Bitcoin inside their walled garden and everyone will simply go along with them. Even in foreign countries where billions of people desperate for liberty live. They’re totally delusional.

In Bitcoin, when you use an ethical Bitcoin wallet, there is no custodian and no custodial legal relationship between the wallet developer or his incorporation and the user. In fact, standard software disclaimers apply (as found in OSX and Microsoft Windows) where the company assumes no liability of any kind for any loss.

Because Bitcoin is software and not money, these disclaimers, end-user license agreements and other standard software customer agreements and contracts apply, not any financial services form of contract these computer-illiterate imbeciles are trying to enforce on Bitcoin companies. The legal relationship in the ethical Bitcoin context is, “You’re on your own, write down your seed phrase and enjoy Bitcoin.” That’s all that is required, and the best Bitcoin wallets will have that as their absolute, fundamental, zero-compromise standard.

As bitcoin is not a financial asset, or an asset held in a custodial account in an ethical Bitcoin wallet, the bitcoin balance displayed in any such wallet cannot be a part of the wallet company’s balance. That idea is simply crazy.

I hate to break it to you, but the U.S. government can’t stop Russians, Iranians, North Koreans, Syrians or the citizens of any country listed on any list from writing software. Eventually, when they stop thrashing themselves with chains they’ll wake up and start using Bitcoin. Very probably it will be Iran that does it first. They’re not stupid, and were able to take over a U.S. RQ-170 Sentinel by hacking into it in flight, taking it over and landing it safely.

Iranians checking out the U.S. RQ-170 Sentinel that they hacked mid-flight and landed safely.

Do you really think people who are skilled enough to pull off a science fiction-level event like this can’t write and manage a Bitcoin wallet? When they do decide to do it (and believe me, it is inevitable), they will not be consulting Lummis and Gillibrand about how they should go about doing it. They’ll become peers on the network and there will be nothing anyone can do to stop them transacting in bitcoin globally.

Is this a national security threat to the United States of America? Not as much as the Fed is. In a strict peer-to-peer network, America will come out stronger if lawmakers follow the Constitution every time. It is America’s freedoms that are its greatest weapons. This Lummis-Gillibrand bill is corrosive to those freedoms and America’s ability to compete, and is therefore more dangerous to America than the Iranian government is.

Was any of it worth it? (Source)

Bitcoin and the services built on it are not “financial services” and should not be subject to regulation any more than book publishing or other speech activities. Federal financial regulators have no control over speech services in the USA. This is nonnegotiable.

Bearing this in mind, it is absurd and unconstitutional that publishers should be in a “sandbox” of any kind for any reason. Bitcoin businesses are not engaged in activities that are financial in nature, any more than McDonald’s is engaging in “financial activity” because they accept electronic or physical money in exchange for beef.

Bitcoin is not a financial product or service any more than an abacus is, and neither is it a delivery service, system or mechanism. The fact that there may be other services that are comparable should not exclude entrepreneurs from trying the same thing simultaneously in a “sandbox.” By nature, the management teams and the models, software and processes they produce will either be superior or inferior to each other and the market will decide which team wins. There is no logical reason to say that a team should be prevented from trying something simply because it is not novel. By this crazy logic, the first company to build a search engine would be eligible for the “search engine sandbox,” but not the second, because the second cannot be novel by its nature. Anyone who knows their history knows many early search engines failed and Google won.

Lummis and Gillibrand are perplexed by this, and want it outlawed. No.

How can it be that a single man in office can stop Americans from running software on their own equipment? Why would any American expose themselves to this sort of potential threat from crony capitalists? Any American with a brain cell, like the people who run LN Markets, would not bother situating their business in the USA at all and would put their business in an ethical jurisdiction where innovation is welcomed and celebrated. Then you’d be able to flash a QR code and participate in this new game they’ve created, called “LN Markets.”

LN Markets, which is a work of genius and innovation on many fronts, would be forbidden from operating in the USA, unchanged. It leverages the unique characteristics of Bitcoin and Lightning in a tour de force of techniques, most notably, using Lightning itself to “log in.” That this innovative company could be forbidden from emerging in the USA should terrify all Americans.

Lummis and Gillibrand want to do the equivalent of controlling the weather. You can’t. You have to live with the weather, and Bitcoin is exactly like that; you have to live with it on its terms. There are many benefits for anyone who does, like going to the beach in Miami to skiing in Colorado.

Once again, the fraudulent miscategorization and conflation of ordinary databases with money is being leveraged as a pretext for the creation of a slew of new laws not later than two years after the passing of this scandalous bill. The illogic here is glaring. They want to increase uniformity to reduce regulatory burden. This will absolutely not be a case of the lowest common denominator. The unjustified, unethical and un-American imposition of money transmitter licenses on people running databases is absurd, and ultimately will be either avoided by users or voided by SCOTUS.

So-called “stablecoins” are nothing more than databases. What a “payment stablecoin” is, I have no idea; why don’t the drafters refer explicitly to the tools and projects they’re trying to destroy? I think they know that if they are named explicitly, they’ll end up with a well-funded adversary like Brad Garlinghouse who will spend $100 million to keep Lummis and Gillibrand out of the gears of his software.

There is a carve-out for companies and individuals doing Bitcoin mining, and astonishingly, non-custodial wallet providers.

This single line alone could make all of this legislation moot. As you will have seen, it is possible to build financial services tools in a non-custodial way. Everyone in Bitcoin will simply move to non-custodial models and earn money from connecting people who have all their money on their phones. This will mean that all the agencies trying to land grab will be rendered irrelevant by their own hand. It also shows that the drafters have no idea how much of a hole this is in their legislation, and how they really don’t understand how anything works at a fundamental level.

Every single company in the space can pivot to be non-custodial by changing their software and ripping out all the user-specific code where people are compelled to “log in.” For people interested in privacy, the aims of the “no login movement” are familiar. Where there is no need to collect information, do not do it. The GDPR in the EU has made many companies wake up to this: if you stop taking people’s information, GDPR goes away and so do the losses from complying with the total insanity coming out of the European Commission.

This suicide pill will have to be removed from the final draft or the law will have no teeth. Every provision is rendered moot by it.

I could be wrong, but this reads to me like if Florida refuses to harmonize with the insane laws and uniform rules that the Consumer Financial Protection Bureau is putting in place and other states are signing up to, the director will adopt rules that will be applied to that state by royal edict. That’s outrageous. Ron DeSantis won’t put up with it, I assure you!

Someone is preparing a research job for themselves. Why does this research need to be done at all? By its nature, decentralized finance and technologies (software) can’t be controlled by the USA, SEC, CFTC, Financial Crimes Enforcement Network or anyone else, so why do you even want to look into it? It will only make you feel powerless and queasy.

In reality, production of these reports can run into the millions of dollars. The annual budget for the Congressional Research Service is $106.9 million. What a monumental waste of money.

As you know, Bitcoin doesn’t waste electricity and by definition, cannot. This was inserted here to placate the insane anti-science Luddites and anthropogenic global warming religious fanatics.

Once again, sowing the seeds for future market interference that only the fat and stupid will obey, who think giving “kudos” to regulators will make their lives easier. Pro tip: It won’t.

Standard-setting is an entirely private and technical matter that the CFTC and SEC have no part in which to play. Just as the World Wide Web set all of its standards — including leaving space in the standard for a future payment method — before the CFTC and SEC had a single thought about any of this. These late-coming Luddites and geriatric meddlers should back off of these things before they taint and poison the landscape with their stink. They should not be consulted or informed in advance of technical specifications on principle and because they’re incompetent and have no right to interfere in publishing.

Consumer literacy? Perhaps they should start with consumer literacy with respect to fiat. Then once they’ve shown everyone they’re competent teachers, they can offer their services free-of-charge to entrepreneurs foolish enough to think these illiterates can educate their clients.

Professional accreditation? Only imbeciles from the State use these proxies to tell them who is and who is not capable of doing their job. The software industry has worked for decades without professional accreditation, which is nothing more than the state creating an obedient guild to control users by proxy. The entire internet was built without professional accreditation in place. It is not needed in Bitcoin either. “Your money is no good here,” Luddites!

Market surveillance is coming to an end with the new features that will be released in Bitcoin making the entire network opaque. You have no business or right surveilling other people’s use of their own money, and Bitcoin is going to shut you out forever. Even if you could see everything, you will never again have enough money to hire violent subhuman thugs to trouble innocent people who are minding their own business.

Foundations are worthless, and so are idiotic “associations.” Several people have tried to impose these old-world structures on Bitcoin, the latest one being the ridiculous Statist poseurs “The B Word.” All of them have failed because the free market has no use for chattering nobodies who are cowards and incapable of serving the market.

As for voluntary and compulsory membership structures, no one in their right mind will join or support a compulsory membership structure. What do they have to gain from it? The only way it would be worthwhile is if membership granted them immunity from trash like this legislation. In absentia of that, it is of no use to anyone. Yet again, this is geriatric fiatism trying to impose its arthritic nonsense on something it can’t understand, rolling out all of the gestures it has from their long history of interference, and concatenating it on to Bitcoin: Bitcoin Association, “Bitcoin Developers Guild,” “Bitcoin Miners Committee,” etc. It is as predictable as it is useless and boring.

These people have no idea about anything. They permute phrases to hand and tack them in front of and behind “Bitcoin,” without any understanding of what anything means. None of them are software developers and this report will be yet another waste of time.

They really think organizational culture can make software safer; this is the level of their total delusion. They’re literally taking two big spoons and mixing up a word salad: pathetic.

This is where delusional, fat, blond kudos-givers believe they’ll be given a chance to steer the juggernaut of regulation away from their businesses and perhaps harm incumbents. It is a dismal, depressing and disgusting form of corruption, where appointees are given a status that has nothing to do with merit, and power that is destructive and anti-American. That they’re to sit next to the CFTC and the Fed should be enough to ward off any ethical person.

69 pages of absolute filth

Inexcusable, un-American and absurd, this shameful document is so bad that no decent person would put their name to it. The only reason why it is not a complete disaster is that any American is free to ignore it should any provision in it become law. Americans can incorporate anywhere in the world and live free.

That’s the way the world works, and Bitcoin is going to make it even better (or worse, if you’re from the class that authors bills like this). Every slave in the Bitcoin future will be one because they choose to be one, not because they’re being forced to be slaves. The entrepreneurial class can avoid this nonsense. There is precedent with the international online gambling companies run by Americans outside of America.

The Bitcoin future is America’s to lose. This bill will help them lose if it becomes law. It should be printed out and then ritually incinerated after being struck down by SCOTUS.

This is a guest post by Beautyon. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc. or Bitcoin Magazine.

Crypto

El Salvador Takes First Step To Issue Bitcoin Volcano Bonds

Published

2 years agoon

November 22, 2022

El Salvador’s Minister of the Economy Maria Luisa Hayem Brevé submitted a digital assets issuance bill to the country’s legislative assembly, paving the way for the launch of its bitcoin-backed “volcano” bonds.

First announced one year ago today, the pioneering initiative seeks to attract capital and investors to El Salvador. It was revealed at the time the plans to issue $1 billion in bonds on the Liquid Network, a federated Bitcoin sidechain, with the proceedings of the bonds being split between a $500 million direct allocation to bitcoin and an investment of the same amount in building out energy and bitcoin mining infrastructure in the region.

A sidechain is an independent blockchain that runs parallel to another blockchain, allowing for tokens from that blockchain to be used securely in the sidechain while abiding by a different set of rules, performance requirements, and security mechanisms. Liquid is a sidechain of Bitcoin that allows bitcoin to flow between the Liquid and Bitcoin networks with a two-way peg. A representation of bitcoin used in the Liquid network is referred to as L-BTC. Its verifiably equivalent amount of BTC is managed and secured by the network’s members, called functionaries.

“Digital securities law will enable El Salvador to be the financial center of central and south America,” wrote Paolo Ardoino, CTO of cryptocurrency exchange Bitfinex, on Twitter.

Bitfinex is set to be granted a license in order to be able to process and list the bond issuance in El Salvador.

The bonds will pay a 6.5% yield and enable fast-tracked citizenship for investors. The government will share half the additional gains with investors as a Bitcoin Dividend once the original $500 million has been monetized. These dividends will be dispersed annually using Blockstream’s asset management platform.

The act of submitting the bill, which was hinted at earlier this year, kickstarts the first major milestone before the bonds can see the light of day. The next is getting it approved, which is expected to happen before Christmas, a source close to President Nayib Bukele told Bitcoin Magazine. The bill was submitted on November 17 and presented to the country’s Congress today. It is embedded in full below.

Crypto

How I’ll Talk To Family Members About Bitcoin This Thanksgiving

Published

2 years agoon

November 22, 2022

This is an opinion editorial by Joakim Book, a Research Fellow at the American Institute for Economic Research, contributor and copy editor for Bitcoin Magazine and a writer on all things money and financial history.

I don’t.

That’s it. That’s the article.

In all sincerity, that is the full message: Just don’t do it. It’s not worth it.

You’re not an excited teenager anymore, in desperate need of bragging credits or trying out your newfound wisdom. You’re not a preaching priestess with lost souls to save right before some imminent arrival of the day of reckoning. We have time.

Instead: just leave people alone. Seriously. They came to Thanksgiving dinner to relax and rejoice with family, laugh, tell stories and zone out for a day — not to be ambushed with what to them will sound like a deranged rant in some obscure topic they couldn’t care less about. Even if it’s the monetary system, which nobody understands anyway.

Get real.

If you’re not convinced of this Dale Carnegie-esque social approach, and you still naively think that your meager words in between bites can change anybody’s view on anything, here are some more serious reasons for why you don’t talk to friends and family about Bitcoin the protocol — but most certainly not bitcoin, the asset:

- Your family and friends don’t want to hear it. Move on.

- For op-sec reasons, you don’t want to draw unnecessary attention to the fact that you probably have a decent bitcoin stack. Hopefully, family and close friends should be safe enough to confide in, but people talk and that gossip can only hurt you.

- People find bitcoin interesting only when they’re ready to; everyone gets the price they deserve. Like Gigi says in “21 Lessons:”

“Bitcoin will be understood by you as soon as you are ready, and I also believe that the first fractions of a bitcoin will find you as soon as you are ready to receive them. In essence, everyone will get ₿itcoin at exactly the right time.”

It’s highly unlikely that your uncle or mother-in-law just happens to be at that stage, just when you’re about to sit down for dinner.

- Unless you can claim youth, old age or extreme poverty, there are very few people who genuinely haven’t heard of bitcoin. That means your evangelizing wouldn’t be preaching to lost, ignorant souls ready to be saved but the tired, huddled and jaded masses who could care less about the discovery that will change their societies more than the internal combustion engine, internet and Big Government combined. Big deal.

- What is the case, however, is that everyone in your prospective audience has already had a couple of touchpoints and rejected bitcoin for this or that standard FUD. It’s a scam; seems weird; it’s dead; let’s trust the central bankers, who have our best interest at heart.

No amount of FUD busting changes that impression, because nobody holds uninformed and fringe convictions for rational reasons, reasons that can be flipped by your enthusiastic arguments in-between wiping off cranberry sauce and grabbing another turkey slice. - It really is bad form to talk about money — and bitcoin is the best money there is. Be classy.

Now, I’m not saying to never ever talk about Bitcoin. We love to talk Bitcoin — that’s why we go to meetups, join Twitter Spaces, write, code, run nodes, listen to podcasts, attend conferences. People there get something about this monetary rebellion and have opted in to be part of it. Your unsuspecting family members have not; ambushing them with the wonders of multisig, the magically fast Lightning transactions or how they too really need to get on this hype train, like, yesterday, is unlikely to go down well.

However, if in the post-dinner lull on the porch someone comes to you one-on-one, whisky in hand and of an inquisitive mind, that’s a very different story. That’s personal rather than public, and it’s without the time constraints that so usually trouble us. It involves clarifying questions or doubts for somebody who is both expressively curious about the topic and available for the talk. That’s rare — cherish it, and nurture it.

Last year I wrote something about the proper role of political conversations in social settings. Since November was also election month, it’s appropriate to cite here:

“Politics, I’m starting to believe, best belongs in the closet — rebranded and brought out for the specific occasion. Or perhaps the bedroom, with those you most trust, love, and respect. Not in public, not with strangers, not with friends, and most certainly not with other people in your community. Purge it from your being as much as you possibly could, and refuse to let political issues invade the areas of our lives that we cherish; politics and political disagreements don’t belong there, and our lives are too important to let them be ruled by (mostly contrived) political disagreements.”

If anything, those words seem more true today than they even did then. And I posit to you that the same applies for bitcoin.

Everyone has some sort of impression or opinion of bitcoin — and most of them are plain wrong. But there’s nothing people love more than a savior in white armor, riding in to dispel their errors about some thing they are freshly out of fucks for. Just like politics, nobody really cares.

Leave them alone. They will find bitcoin in their own time, just like all of us did.

This is a guest post by Joakim Book. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This is an opinion editorial by Federico Tenga, a long time contributor to Bitcoin projects with experience as start-up founder, consultant and educator.

The term “smart contracts” predates the invention of the blockchain and Bitcoin itself. Its first mention is in a 1994 article by Nick Szabo, who defined smart contracts as a “computerized transaction protocol that executes the terms of a contract.” While by this definition Bitcoin, thanks to its scripting language, supported smart contracts from the very first block, the term was popularized only later by Ethereum promoters, who twisted the original definition as “code that is redundantly executed by all nodes in a global consensus network”

While delegating code execution to a global consensus network has advantages (e.g. it is easy to deploy unowed contracts, such as the popularly automated market makers), this design has one major flaw: lack of scalability (and privacy). If every node in a network must redundantly run the same code, the amount of code that can actually be executed without excessively increasing the cost of running a node (and thus preserving decentralization) remains scarce, meaning that only a small number of contracts can be executed.

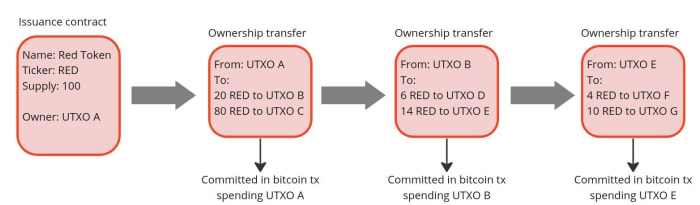

But what if we could design a system where the terms of the contract are executed and validated only by the parties involved, rather than by all members of the network? Let us imagine the example of a company that wants to issue shares. Instead of publishing the issuance contract publicly on a global ledger and using that ledger to track all future transfers of ownership, it could simply issue the shares privately and pass to the buyers the right to further transfer them. Then, the right to transfer ownership can be passed on to each new owner as if it were an amendment to the original issuance contract. In this way, each owner can independently verify that the shares he or she received are genuine by reading the original contract and validating that all the history of amendments that moved the shares conform to the rules set forth in the original contract.

This is actually nothing new, it is indeed the same mechanism that was used to transfer property before public registers became popular. In the U.K., for example, it was not compulsory to register a property when its ownership was transferred until the ‘90s. This means that still today over 15% of land in England and Wales is unregistered. If you are buying an unregistered property, instead of checking on a registry if the seller is the true owner, you would have to verify an unbroken chain of ownership going back at least 15 years (a period considered long enough to assume that the seller has sufficient title to the property). In doing so, you must ensure that any transfer of ownership has been carried out correctly and that any mortgages used for previous transactions have been paid off in full. This model has the advantage of improved privacy over ownership, and you do not have to rely on the maintainer of the public land register. On the other hand, it makes the verification of the seller’s ownership much more complicated for the buyer.

Source: Title deed of unregistered real estate propriety

How can the transfer of unregistered properties be improved? First of all, by making it a digitized process. If there is code that can be run by a computer to verify that all the history of ownership transfers is in compliance with the original contract rules, buying and selling becomes much faster and cheaper.

Secondly, to avoid the risk of the seller double-spending their asset, a system of proof of publication must be implemented. For example, we could implement a rule that every transfer of ownership must be committed on a predefined spot of a well-known newspaper (e.g. put the hash of the transfer of ownership in the upper-right corner of the first page of the New York Times). Since you cannot place the hash of a transfer in the same place twice, this prevents double-spending attempts. However, using a famous newspaper for this purpose has some disadvantages: